are funeral expenses tax deductible in australia

The IRS says that if the estate pays the funeral costs such as when using pre-paid plan the estate can use the expenses against its taxes as a deduction. This cost is only tax-deductible when paid for by an estate.

03 Chapter 4 Deductions From Gross Estate Part 01

The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

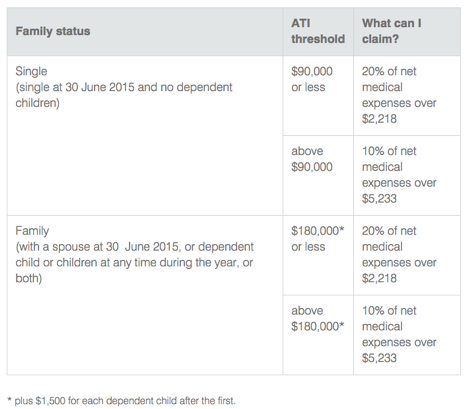

. Is funeral insurance tax deductible. Qualified medical expenses include. You may also claim the cost for getting the COVID-19 vaccine claims scheme medical report.

Funeral bonds and prepaid funerals - Services Australia. When a person dies generally the person responsible for administering the deceased estate is the legal personal representative. Find out more on what out of pocket expenses you can claim in the COVID-19 vaccine claims scheme policy on the Department of Health website.

Funeral costs you pay for in advance normally dont count in your assets test for payments from us. Are funeral expenses tax deductible in Australia. No never can funeral expenses be claimed on taxes as a deduction.

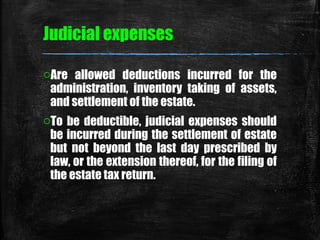

The funeral expenses were paid in 2011 and the employee died in 2010 so I know its a 1099 at worst not a W-2. Can I deduct funeral expenses probate fees or fees to administer the estate. Deducting funeral expenses as part of an estate.

Yes funeral expenses are a personal expense so the family or the trust cant claim them. Of course management doesnt want the estate to pay any taxes and Im left. Deceased bodies for a funeral service then of course all those sorts.

This person may be an executor or administrator who has been granted probate or letters of administration by a court. Whats more this may not apply to your specific situation. Schedule JFuneral Expenses and Expenses Incurred in Administering Property Subject to Claimsis the proper place to enter the expenses.

Funeral expenses are not tax deductible because they are not qualified medical expenses. While the IRS allows deductions for medical expenses funeral costs are not included. These are personal expenses and cannot be deducted.

For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form. Funeral expenses should be itemized on Line 1 Section A and the total of the expense should be entered under Total If the estate was reimbursed for. In short these expenses are not eligible to be claimed on a 1040 tax form.

What expenses can I. Permits for example for a burial at sea or private land burial or. Individual taxpayers cannot deduct funeral expenses on their tax return.

Deductible medical expenses may include but are not limited to the following. If you pay for a 10000 funeral today that might not buy very much in 15 years. You can claim out of pocket costs linked to the harm you suffered like consultations with doctors and medical aids.

Company paid funeral expenses. If you choose to report funeral expenses on the estates tax return use form 706. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

No there are usually no changes to the tax rules around life insurance when you retire. But theres generally no tax on the benefits that you or your beneficiaries will receive. So you think you have your funeral expenses taken care of when you might only have enough money to buy a casket.

Many estates do not actually use this deduction since most estates are less than the amount that is taxable. The IRS deducts qualified medical expenses. A typical funeral will have these costs.

Australias weirdest tax deductions. There are some exceptions. There are no inheritance or estate taxes in Australia.

Funeral expenses are not tax-deductible. While most funeral expenses are not tax deductible for individuals the rules change when the estate pays for the burial costs. Another limit with a prepaid funeral is that your family has to use the funeral home where you set up the prepaid plan.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Do tax rules change when I retire.

The business but a whole range of employee entertainment expenses are deductible. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate.

Premiums paid for this type of cover are not generally tax deductible. Funerals can cost from 4000 for a basic cremation to around 15000 for a more elaborate burial. In other words funeral expenses are tax deductible if they are covered by an estate.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Australian taxpayers claiming interest deductions on a financing arrangement from a related foreign interposed zero or low-rate entity broadly a jurisdiction with tax rates of 10 or less or jurisdictions that may offer tax concessions need to consider the potential application of complex integrity rules which were introduced as part of. They are never deductible if they are paid by an individual taxpayer.

Funeral insurance covers you for a limited benefit usually up to 15000 to help your loved ones with the cost of your funeral if you pass away. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. In most cases funeral insurance premiums are not tax deductible.

Our company has paid the funeral expenses directly to the funeral home for a recently deceased employee of about 250000. However its always possible that tax laws may change in future. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible.

Medical Expenses Tax Offset Online Tax Australia

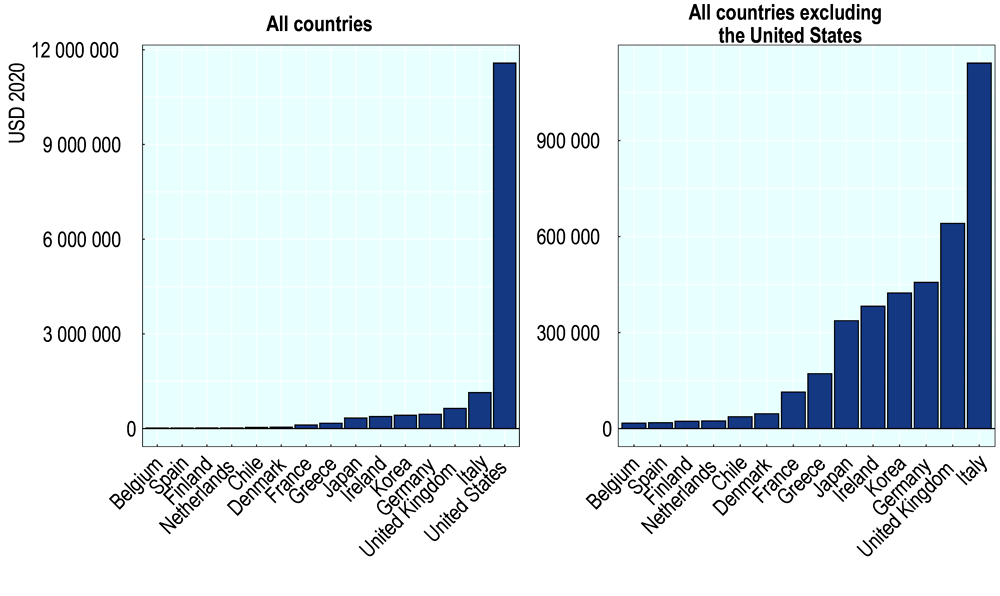

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Should We End Tax Deductibility On Business Interest Payments Ft Readers Respond Financial Times

What Tax Deductions Can I Claim Go To Court Lawyers

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Tax Deductions For Office Admin Let S Boost Your Tax Refund

Charitable Gifts And Donations Tracker Template Excel Templates Charitable Gifts Donation Letter Donation Form

How Much Should You Donate To Charity District Capital

03 Chapter 4 Deductions From Gross Estate Part 01

Benefits Of Having Comprehensive Car Insurance Comprehensive Car Insurance Car Insurance Best Car Insurance

Working From Home Tax Deductions What Can You Claim Canstar

What Tax Deductions Can I Claim Go To Court Lawyers

Is Life Insurance Tax Deductible Canstar

What Are Non Deductible Expenses Rydoo

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary